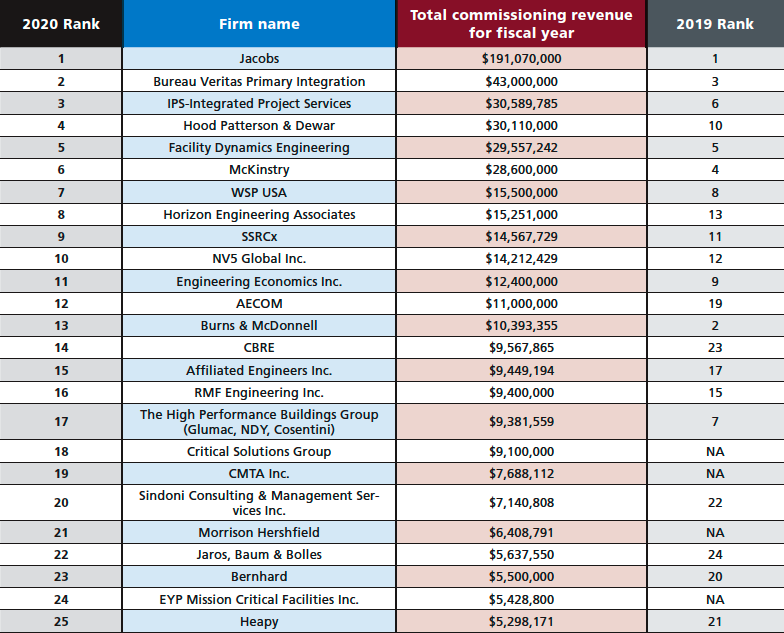

Commissioning Giants, The 2020 Commissioning Giants data reports on the top 25 firms

“For the 2020 Commissioning Giants report, the top 25 companies made $536 million in revenue, a slight dip from last year’s $551 million.“

The 2020 Commissioning Giants reports the top 25 firms based on whether the company chose to be considered in this year’s rankings. The average percentage of commissioning revenue earned by the 2020 Commissioning Giants was approximately 31%, showing that these top 25 firms earn a great deal of their revenue from commissioning, with two firms earning 100% of their revenue solely from commissioning. See Table 1 for the complete ranking, including the four new companies.

For the 2020 report, the top 25 companies made $536 million in revenue, a slight dip from last year’s $551 million. The majority (44%) of firms are consulting-engineering firms with a commissioning division; about a quarter (24%) are commissioning-focused firms. Firm ownership type fell into four categories: private (36%), public (28%), employee-owned (24%) and limited liability company (12%).

The average commissioning fee per project varied. Forty-four percent of companies earned $100,001 to $300,000, 28% earned $25,001 to $50,000 and 20% earned $50,001 to $100,000. Only 8% earned more than $300,000 per project.

This data reflects commissioning at all levels: new buildings (43%), existing buildings (12%), retro-commissioning (11%), whole building (10%), emergency power systems (6%), building enclosure (envelope, 5%), recommissioning (5%), monitoring-based (4%), fire protection systems (3%) and communications systems (2%). Each reporting firm completed, on average, 251 commissioning projects (at any level) in 2019, up from 239 in last year’s report.

The top three building types commissioned by these firms:

- Data centers: 20%.

- Hospitals/health care facilities: 20%.

- Colleges/universities: 10%.

According to survey respondents, these firms were contracted to complete commissioning for a variety of reasons: mandates (codes, standards, benchmarking: 92%), savings (energy efficiency, lower life cycle cost: 92%) and sustainability (long-term materials and performance efficiency: 92%.) Other reasons included resiliency (68%) and marketability of the property (44%).

Commissioning challenges

The 2020 Commissioning Giants study asked for information related directly to challenges for these firms. The top three current challenges for the 2020 Commissioning Giants are:

- Staffing: quality of young commissioning professionals (36%).

- Staffing: keeping older commissioning professionals trained/current (16%).

- The economy’s impact on the construction market (12%).

Future challenges varied. The No. 1 challenge was the “lack of knowledge about commissioning’s worth,” with 60% respondents saying it was a problem (an uptick from 48% last year). The next challenge, at 48%, was “lack of funding or buy-in (from owners, engineers, etc.) to conduct commissioning.” Moving into third place this year at 44% was “not enough commissioning authorities or agents or commissioning professionals.” This surpassed “codes and standards changing,” which came in at 28% this year, an increase from 20% in the previous report.

By Amara Rozgus, Editor-in-Chief